Stolen Checks

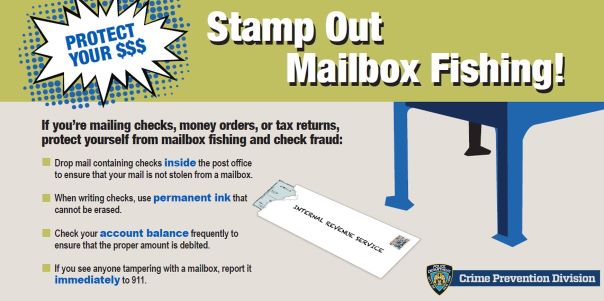

Fraudsters can steal checks and alter them to benefit themselves. Two ways they get checks include:

- Stealing them from a mailbox and using chemicals or software to alter the amount and payee. They then deposit or cash the altered check in their name.

- Stealing blank checks, make them payable to themselves, and forge the drawer's signature.

Victims may not discover the scam until an unexpected withdrawal occurs or a check does not arrive as expected.

Protecting Yourself

- Move to other forms of payment, such as debit or credit cards.

- Check your bank or credit union accounts regularly for unusual activity.

- Use online bill payers to send payments securely to utilities, creditors, and other companies. We offer this service for free on PAL Plus and our mobile app!

- Do not mail checks by leaving them in your mailbox. Drop them off at the post office.

- Check your mail daily, especially if you’re expecting a check. If you sign up for the USPS informed Delivery service, it will email you what mail is expected to arrive each day.

If You Become a Victim

- Take the following actions right away:

- Notify your bank or credit union for any check payments you did not expect or cannot find.

- For stolen blank checks, contact your bank or credit union to put stop payments on all of them.

- File a police report.

- File a complaint with the FTC at https://reportfraud.ftc.gov/.

Watch this video from ABC 7 News for more on checks getting stolen in the mail: